Overview

By offering a system for conducting dealing operations, which are crucial for the profitability of retail FX/CFD brokers, cryptocurrency exchanges, securities, and banks, as a SaaS, we provide industry best practices with high cost performance. Additionally, to achieve higher profitability, we propose unique algorithms tailored to each company.

Features

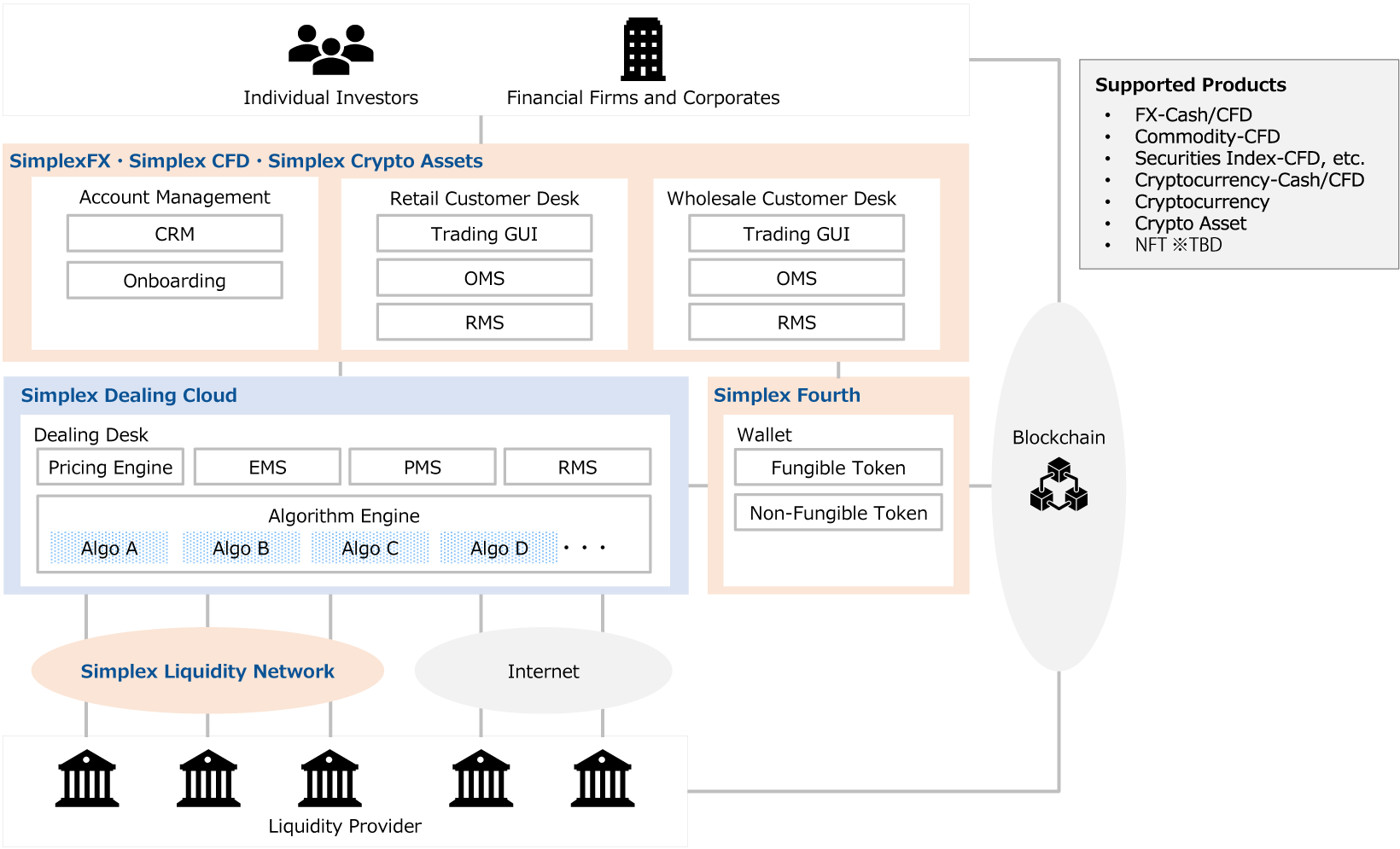

Various products on one platform

FX Cash (Spot/Forward/Swap/NDF), FX on Margin(or CFD), any other CFD products that have the underlying financial asset, Crypto Assets cash trading that requires wallet to wallet settlement and its CFD. NFT will be added soon.

Our SaaS model incorporates our expertise in dealing, enabling the swift and straightforward establishment of a new dealing desk.

Our SaaS package includes proprietary dealing know-how, allowing you to launch your business with best practices. We provide guidance on adopting and setting up our system as you start your own venture, and we continue to support your business as it grows.

Freeing dealers from round-the-Clock monitoring tasks with diverse automation features.

Using our various automated functions, the dealer can get away from the monitoring work day and night and redirec the resource to more profitable jobs.

Pursuing higher profitability using our dealing algorithms on algo-engines

Drawing from over 20 years of experience providing dealing consultancy services to financial institutions, including retail FX amid spread competition, our expertise informs our proprietary dealing algorithms and tuning know-how, resulting in high profitability. Our specialized dealing experts propose optimal dealing algorithms tailored to each company's characteristics.

Adaptable to all business types through integration with other solutions

By combining our solutions with others, we can provide a full lineup of systems necessary for various business types, including financial futures (retail FX/CFD), cryptocurrency exchanges, securities firms and banks. Additionally, through API integration, you have the freedom to use our solution in conjunction with your own or other companies’ solutions.

High functionality and availability

Leveraging our proprietary financial middleware developed through high-frequency stock trading, we achieve exceptional processing performance, capturing market movements worldwide to seize revenue opportunities. Additionally, our clustered architecture ensures high availability, enabling seamless failover during system disruptions to maintain uninterrupted operations.

Functions

- Connection library over 30 LPs and exchanges

- Configurable ESP and RFS quotes

- Bad Tick Filtering

- OMS, EMS

- PMS

- SOR

- FOK/IOC, RFS Order, Resting Order

- Strategy Order (TWAP)

- Able to schedule dynamic parameters change

- Various dealing algorithms on Algo Engine

- Various reporting

Product Image

Benefits

Quick dealing desk start-up, simplified operations and improving profit at the best cost-performance

By leveraging advanced expertise and swiftly launching specialized dealing operations that are not commonly shared, we enhance operational efficiency and leverage knowledge gained from dealing consulting to improve revenue. Additionally, through SaaS-based delivery, our products receive daily updates, ensuring optimal cost performance for users.

Service and Support

Operational maintenance services at the financial industry standard and business/revenue improvement services by dealing consultants

As a financial service, we provide 24/7 support, incident reporting during emergencies, and implementation of preventive measures. Our high-quality troubleshooting support, built on years of financial service delivery, ensures safe and secure operations. Additionally, our expert services, including dealing consultants, can assist with business efficiency and revenue improvement.