Overview

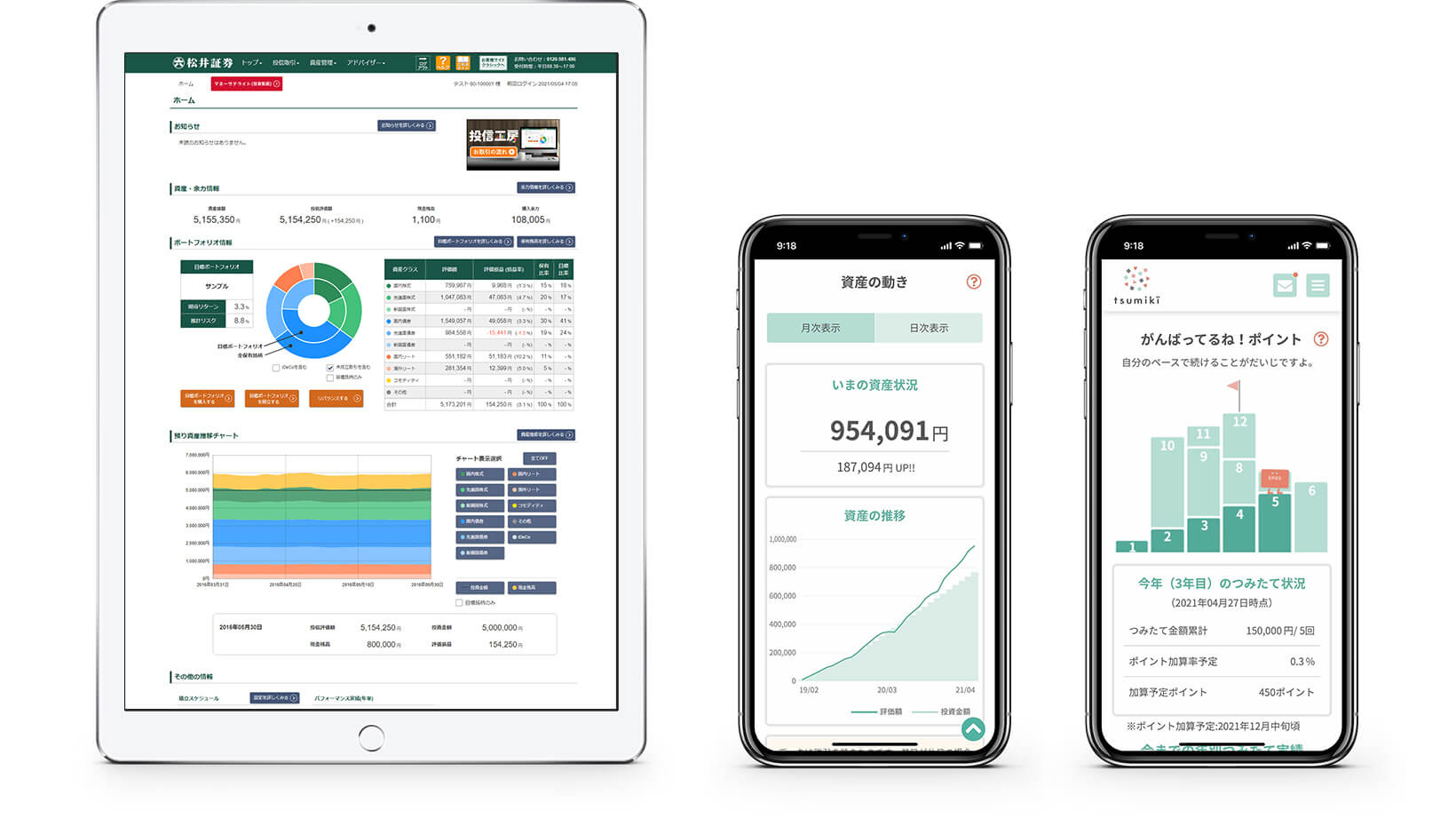

It is an asset management solution for individual investors that provides services such as Robo-Advisors, Credit Card Savings Plans, Point Investment, Stock Ownership Plans, and Workplace NISA. It supports multichannel access via PC web and smartphone applications.

Features

Flexible customization

The asset management solution is composed of web components, which allows for flexible customization to match the customer’s business model and target users, and can quickly respond to changing requirements.

Substantial experience in connectivity

Upon implementation, the substantial experience in connectivity with core systems and information systems allows for flexible adaptation and smooth introduction.

Supporting multi-channel

Supporting PCWeb, Smartphone web/app(iOS, Android)

Functions

- Risk Tolerance Assessment

- Portfolio Block Order

- Portfolio Proposal

- Bulk Portfolio Accumulation

- Backtesting/Forward Testing

- Point Investment (Simulated Investment)

- Risk/Return Map

- Point Investment (Real Investment)

- Goal-Based Simulation

- iDeCo Integration

- Automatic Rebalancing

- Fund Screening

- Credit Card Savings Plan

Product Image

Benefits

In the era of a “100-year life” and the “20 million yen problem for post-retirement”, awareness of asset management issues is gradually increasing. However, the habit of savings is still strong in Japan, with the amount said to be as much as 1,100 trillion yen. Financial institutions are being forced to change their revenue structures, and it is essential to strengthen stock business through mass-market approaches. Our company supports a full lineup of asset management tools suitable for our customers’ business environments.

Service and Support

Customization available

By customizing the implementation channels and features, we provide solutions that best meet our customers’ needs.

24/7 Support

We provide support 24/7 from unexpected incident response to preventive maintenance and troubleshooting services.