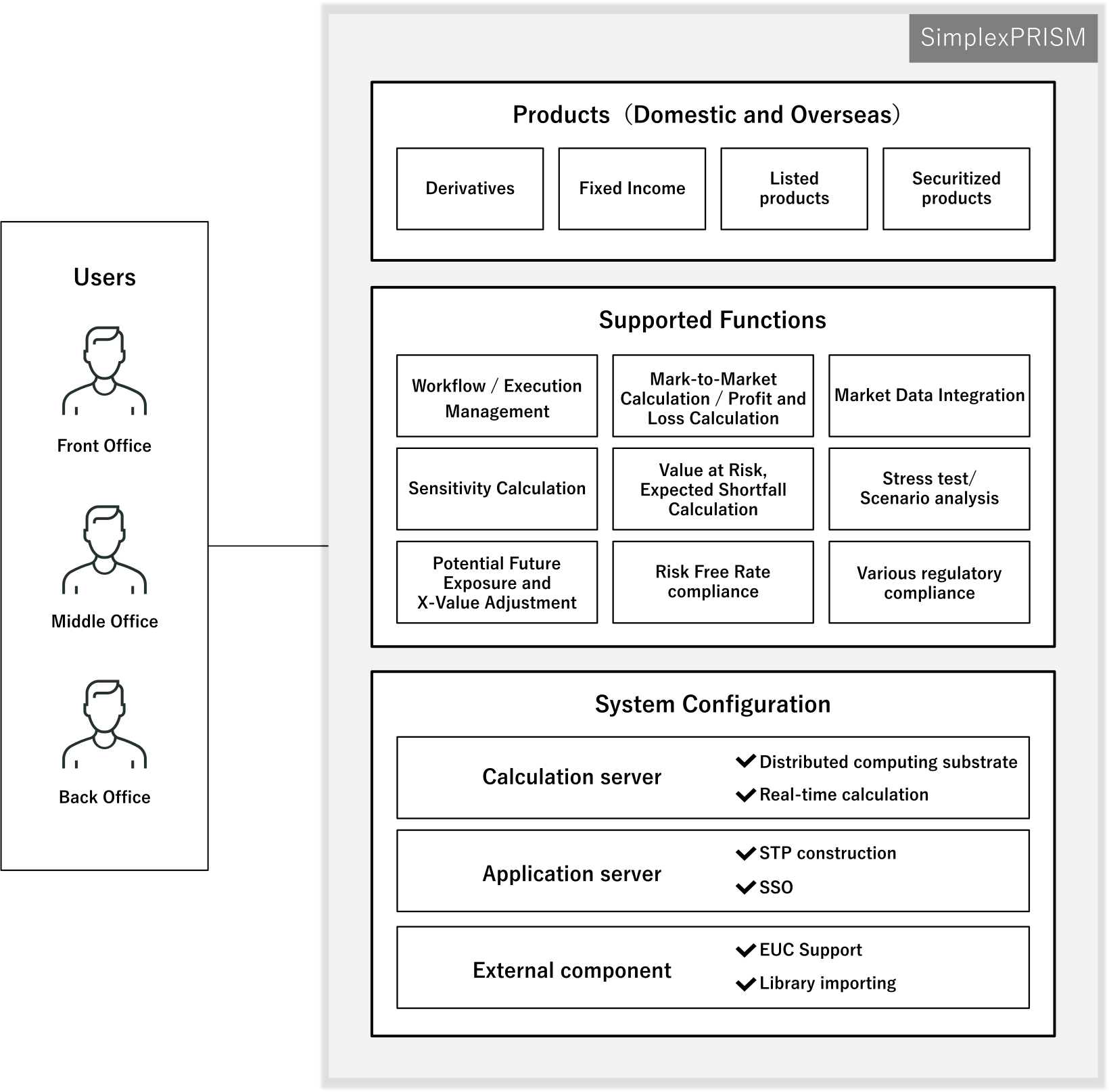

Overview

A platform solution that supports overall trade and risk management in capital markets. It covers a wide range of products such as interest rates, foreign exchange, credit, and equities, enabling integrated management of OTC and listed products.

Features

Over 200 products are tradeable

From high-volume plain products to small quantities of exotic products, we support over 200 types of products. Whether dealing with a limited range of products or a mix of numerous items, we provide trading assistance tailored to your portfolio’s characteristics.

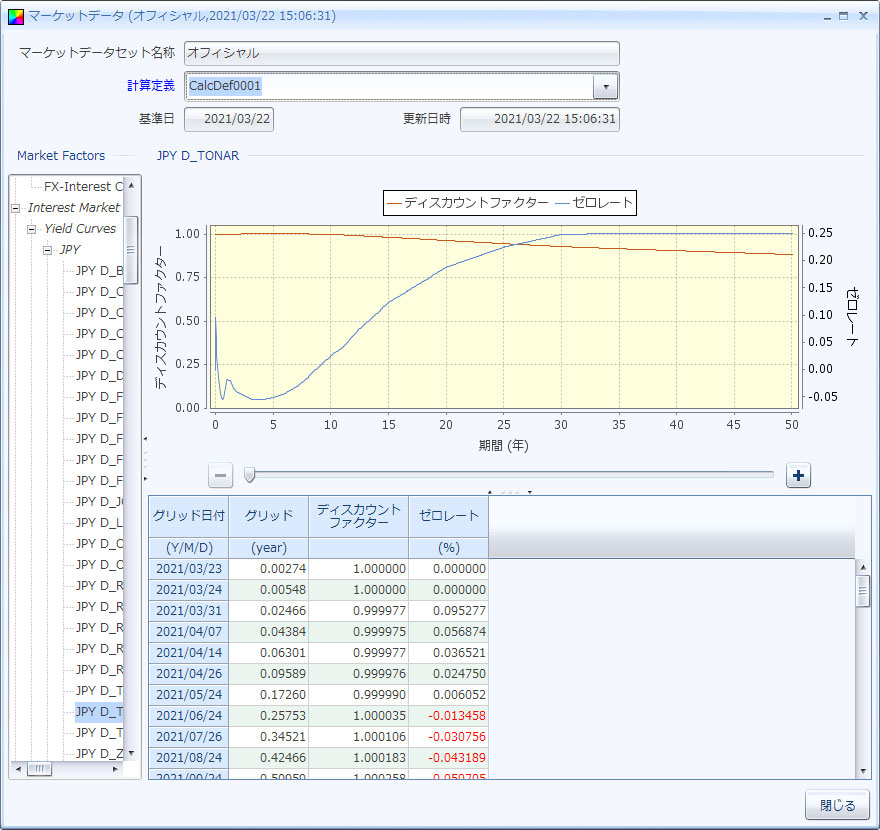

High-speed calculation by distributed computing platform

Equipped with distributed computing capabilities that efficiently process tasks using dozens to hundreds of CPUs, our system enables rapid valuation and risk assessment even for diverse portfolios with high trading volumes. The robust computational base also accommodates complex simulation models that require extensive calculations, addressing various business needs.

Addressing the latest regulatory and Industry trends and changes

We respond to ever-changing industry trends and various regulations, including those represented by BIS regulations. With a top-class team of quantitative researchers, we continuously monitor cutting-edge industry developments to provide swift solutions. Specific examples of our responses include margin regulations, SA-CCR, IRRBB, risk assets, and XVA.

Functions

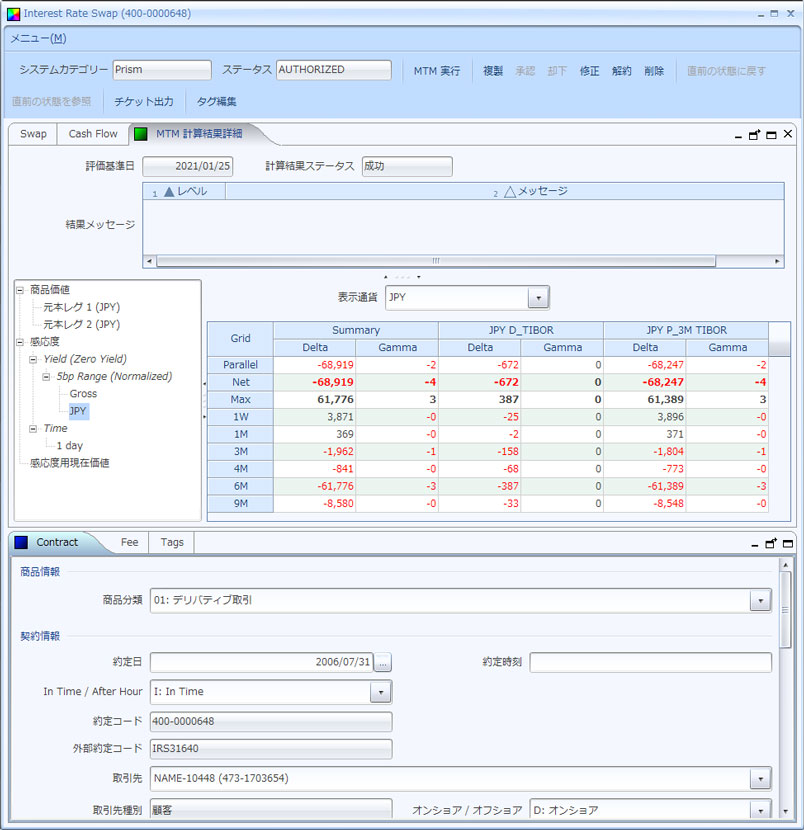

- Transaction Management

- Mark-to-Market

- Risk evaluation

- Stress test

- Scenario analysis

- Regulation compliance

Supported Products

- Interest rate derivatives

- FX derivatives

- Credit derivatives

- Equity derivatives

- Fixed income

- Listed products

Product Image

Benefits

Supporting capital market operations on one-platform

Responding flexibly to ever-changing industry trends

Covering front, middle, and back-office functions across the market, our one-platform helps you conduct your business operations. We flexibly accommodate integration with information and accounting systems by STP and third-party calculation libraries based on your specific needs. Even after system implementation, we can continuously adapt to industry trends and regulatory changes, such as LIBOR cessation and BIS regulations.

Service and Support

From system planning to maintenance and support after implementation

Providing total support as each customer needs

We provide implementation support tailored to the unique business needs of each company, including product selection and risk measurement criteria. Additionally, in addressing industry trends where standardized approaches are less defined, our team of financial engineers can assist with system roadmaps and internal process optimization. From system planning to implementation and maintenance, we offer consistent service throughout.